accumulated earnings tax irs

The tax rate on accumulated taxable income currently stands at 20 and fortunately the American Taxpayer Relief Act ATRA kept it from rising to a. The government taxes accumulated earnings so as to prevent corporations from not paying dividends to its shareholders.

Strategies For Avoiding The Accumulated Earnings Tax Krd

According to the IRS anything.

. Publicly held corporations with many. If a corporation pursues an earnings accumulation strategy where the accumulation is to avoid the tax on dividends rather than having a business purpose then IRC 532 provides an accumulated earnings tax that can be assessed on accumulated earnings with no clear business purpose. Deductions are allowed for federal income taxes paid excess profit taxes paid to foreign.

Our system imposes a 20 percent tax on accumulated taxable income of a corporation availed of to avoid tax to. The base for the accumulated earnings penalty is accumulated taxable income. As we approach mid-2021 political discussions are focused on raising more tax revenue particularly from the wealthy.

The IRS also allows certain exemptions based on the required need for the accumulated earnings. Exemption levels in the amounts of 250000 and 150000 depending on the company exist. Dividends are taxed higher than capital.

A corporation determines this amount by adjusting its taxable income for economic items to better reflect how much cash it has available to make dividend distributions. 535 a Accumulated taxable income means the taxable income of the corporation MINUS ALL of the following. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed.

The Causes of the Accumulated Earnings Tax Penalty and How to Avoid It Mable W. There is a certain level in which the number of earnings of C corporations can get. IRC 532 a states that the accumulated earnings tax imposed by IRC 531 shall apply to every corporation other than those described in subsection IRC 532b formed or availed of for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation by permitting earnings and profits to accumulate instead of being.

The accumulated earnings tax rate is 20. IRS Use of Accumulated Earnings Tax May Increase. As a practical matter the tax is col-.

The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation by permitting earnings and profits to accumulate instead of being divided or distributed. The threshold is 25000 without accumulated earning tax.

It compensates for taxes which cannot be levied on dividends. Key Takeaways An accumulated earnings tax is a tax on retained earnings that are considered unreasonable which should be paid out as. He accumulated earnings tax AET is imposed by Internal Revenue Code IRC section 531 on C corporations formed or availed of for the purpose of avoiding the imposi-tion of income tax on their shareholders by permitting earnings and profits to be accumulated instead of being distrib-uted.

The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. Dividends Paid In That. Accumulated Earnings Tax.

The tax is in addition to the regular corporate income tax and is assessed by the IRS typically during an IRS audit. This tax evolved as shareholders began electing to have companies retain earnings rather than pay them out as dividends in an effort to avoid high levels of taxation. 21 rows Accumulated Earnings Tax.

Accumulated Earnings Tax can be reduced by reducing Accumulated Taxable Income. Volume 38 Issue 1 Article 11 1-1976 Tax Forum. IRC Section 535c1 provides that.

What is the Accumulated Earnings Tax. In addition to other taxes imposed by this chapter there is hereby imposed for each taxable year on the accumulated taxable income as defined in section 535 of each corporation described in section 532 an accumulated earnings tax equal to 20 percent of the accumulated taxable income. Code 531 - Imposition of accumulated earnings tax.

ACCUMULATED TAXABLE INCOME. If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes is beyond the reasonable needs of the business the corporation may be assessed tax penalty called the accumulated earnings tax IRC section 531 equal to 20 percent 15 prior. Defend against Accumulated Earnings Tax.

When the revenues or profits are above this level the firm will be subjected to accumulated earnings tax if they do not distribute the dividends to shareholders. The Accumulated Earnings Tax is more like a penalty since it is assessed by the IRS often years after the income tax return was filed. A corporation can accumulate its earnings for a possible expansion.

Breaking Down Accumulated Earnings Tax. How the accumulated earnings tax functions The prohibited purpose triggering potential imposition of the AET is an intention to avoid a second-tier tax on dividends paid to individual shareholders. Pursuant to 26 USC.

The Accumulated Earnings Tax is computed by multiplying the Accumulated Taxable Income IRC Section 535 by 20.

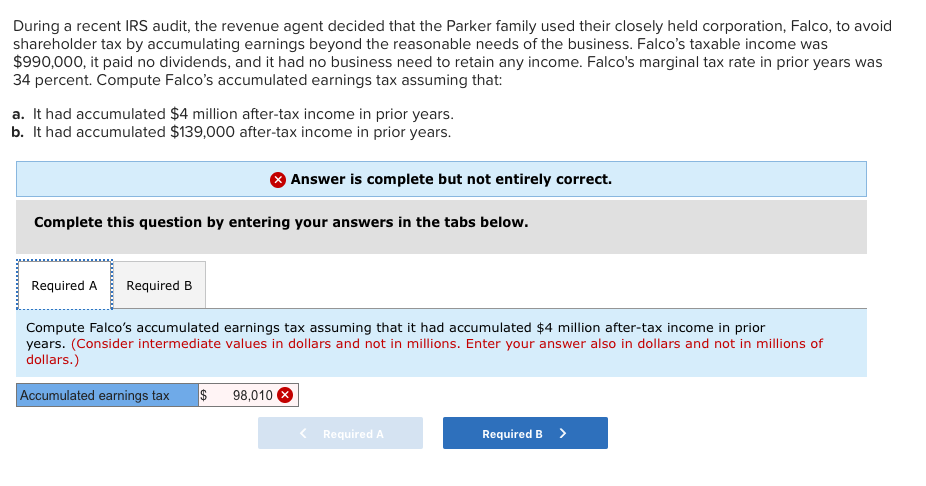

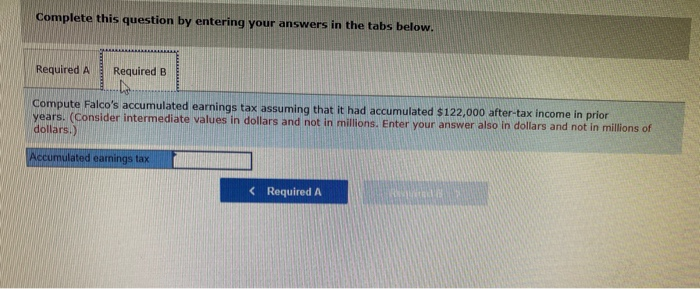

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Earnings And Profits Computation Case Study

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Cares Act Implications On Corporate Earnings And Profits E P

Irs Use Of Accumulated Earnings Tax May Increase

Solved Determine Whether The Following Statements About The Chegg Com

How To Calculate The Accumulated Earnings Tax For Corporations Universal Cpa Review

Bardahl Formula Calculator Defend Against Accumulated Earnings Tax